The relationship between marketing and finance is arguably one of the most important in any business. When these two groups share the same vision and work together to quantify marketing’s contribution to the business, the company has a greater chance of accelerating growth.

But that’s easy to say and hard to do when the macroeconomic environment is challenging, and the future looks uncertain. Here are four things marketers can do to strengthen their relationship with finance and cement marketing as the engine of business growth:

1. Understand the finance mindset

Inherently, CFOs and their teams take a balanced approach to risk as they juggle investment decisions across many different departments. When it comes to marketing, they require proof of why investments will pay back, how much, and when. According to recent research, it takes CPG advertising 94 weeks to pay back on average. The earliest payback is 61 weeks, meaning even the best-performing brand does not see a return within a year – an important consideration if marketers are being asked to cut spend.

Read more: Three key takeaways from Profit Ability 2 that prove advertising really is effective

Finance and marketing teams also need to be batting for the same team if they are to be successful. Here are two approaches you can take to avoid an ‘us vs them’ relationship:

- Build cross-functional teams to ensure you are integrating finance at the heart of the process when building ROI models.

- Encourage curiosity by inviting finance into marketing conversations and asking them to stress test assumptions, for example. As well as ensuring transparency, this will help to build trust and lead to more integrated business outcomes.

2. Wear a bigger hat

The CFO and executive team are making significant company decisions amid heightened uncertainty. From current cash flow and future demand to supply chain concerns and the needs of employees and shareholders, there is a huge amount to consider.

Marketers can play a key role in helping senior leaders to make better decisions by identifying areas of uncertainty where they can add value. Think about the data you have access to about consumers, distribution channels, pricing, and promotions that can all add value to decision-making.

But always bear in mind that you need to link the insights you unearth to relevant business outcomes, such as revenue, customer acquisition and value, cash flow, and shareholder value. Failure to do so will impede marketers’ ability to build a strong and trusting working relationship with their peers in finance.

3. Use zero-based budgeting

In times of uncertainty, cash and cash management are of central importance to finance. Marketers must understand and acknowledge this reality. Zero-based budgeting – a method that requires all expenses to be justified for each new period – can help to articulate the key lines of spend over the short and long term. For example:

- Which audience do you really need to reach?

- Why are you trying to reach this audience (e.g., maintaining existing demand versus growing future demand)?

- Can we reach the same audience more efficiently (e.g., by swapping dayparts on TV, by moving from linear to digital, or by increasing social)?

- Can we reduce our reliance on paid and get more from our owned assets?

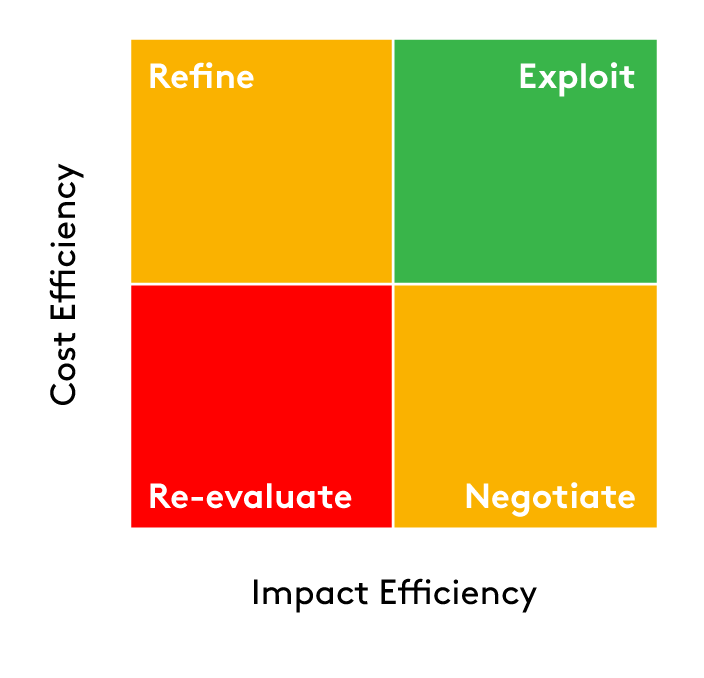

Summarizing the answers to such questions in the following quadrant can help marketers to zone in on activities that have a big impact at an acceptable cost and, therefore, should be maintained. It also highlights other activities that should be examined more closely.

Using this approach to test assumptions and formulate a revised plan as to how to spend marketing budgets can ensure that marketers get the maximum return for their investments.

4. Run scenarios

Backward-looking studies that claim a steady and predictable relationship between companies that advertise during a downturn and growing market share in the future are unlikely to cut much ice with the CFO.

Instead, planning for a range of different potential future states enables businesses to make budgetary decisions with more confidence. Marketing teams are in a strong position to lead this process thanks to the data and insights they have on both the business and its customers. Scenario planning can help to answer important questions, such as:

- How will your strategy change if there’s a deep recession in your largest market?

- What will be the impact if there’s an issue with a key part of your supply chain?

- What would happen to your KPIs if you were to increase your prices by 5%?

- What could you do if a new entrant disrupts your category?

While no outcome is guaranteed, you can identify lead indicators that reveal which future state is most likely. Many retailers and consumer goods manufacturers track changes in house prices as it reflects how ‘wealthy’ people feel, for example. Lead indicators will vary by sector and by company, but the crucial thing is to plan across a range of possible future states and use lead indicators to pivot towards the most likely.

Read more: How mastering the power of foresight helps marketers to plan more effectively

Helping to make the best possible decisions about where to invest for growth is a great way for marketing to strengthen its alliance with finance.

Contact Jon to discuss any of the issues raised in this article.

A version of this article first appeared in WARC.